Dunkin' Brands: Good Business, Better Industry

If someone new to investing were to ask me where to start when trying to find potential investments, I would recommend first studying predictable, free cash flow generative businesses with a defensible competitive position. I can’t value a business if I can’t reasonably estimate the cash the business will generate over the next 5+ years, and I am only interested in owning above average businesses which tend to display the above characteristics. Secondarily, but of no less importance, is to pay a price for that business that affords a margin of safety in case some of your assumptions are off the mark.

We try to spend most of our time researching businesses that meet these criteria, and this week I’ll take a look at Dunkin’ Brands Group, owner of the Dunkin’ and Baskin-Robbins franchises and a business that scores highly on many of these marks.

Business Overview

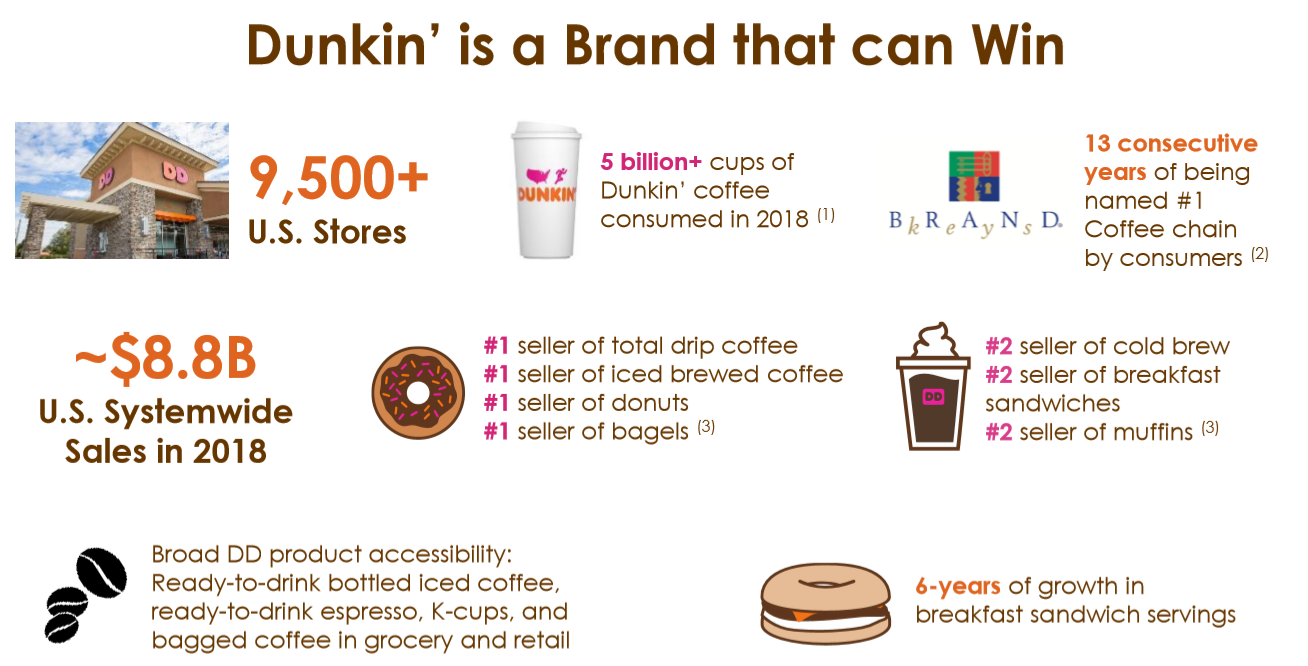

Dunkin’ employs a simple, 100% franchised operation with a presence in 60 countries and over 21,000 locations. Their Dunkin’ brand occupies a leading position in hot and cold coffee, donuts, bagels, and breakfast sandwiches in the U.S. while Baskin-Robbins offers premium ice cream options primarily abroad.

Source: 2019 Q3 Investor Presentation

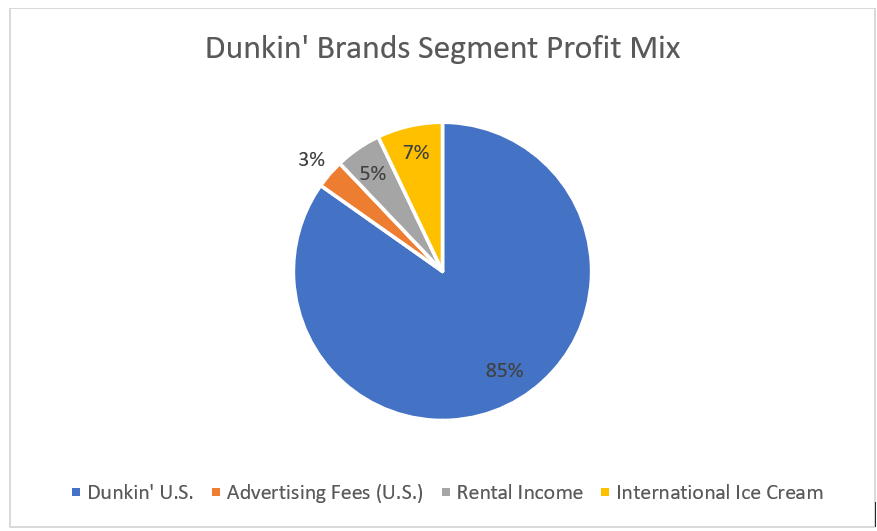

While ~17% of segment revenue comes from Baskin Robbins and Dunkin’ International, the long term growth and profitability driver is Dunkin’ U.S (~85% of segment profits), and accordingly is where I’ll spend the bulk of this article.

Dunkin’ Brands has roots tracing back to the 1940s and competes in the Quick Serve Restaurant (QSR) space against the likes of Starbucks, Burger King, Panera, Wendy’s and many others. Originally focused on breakfast foods, since the 1980s Dunkin’ has transformed into a beverage-based concept and a national leader in the coffee category with over 5 billion cups of Dunkin’ coffee consumed in 2018. After going through a stint of private equity ownership by Bain Capital, the Carlyle and Thomas H. Lee Partners, the company IPO’d in 2011. Since going public the shares have returned high-teens annually (through 2019), comfortably outpacing the S&P 500 over the same period.

Business Model

Franchisors historically earn high returns on capital and can grow without redeploying earnings back into the business, making them inherently high-return investments for shareholders in many cases. Dunkin’ employs a strictly franchise-based approach and has the benefit of serving the habitual and loyal caffeinated beverage market.

Franchise Model

Dunkin’ operates an attractive 100% franchised model. Without the distraction of owning and operating even a small portion of its restaurants, this allows the company to:

1) focus its attention on strengthening the brand by way of menu innovation, marketing, and franchisee coaching and support; and

2) steadily grow earnings while deploying little capital back into the business. This results in a highly free cash flow generative business that can return substantial capital to shareholders while the underlying business continues to grow.

o To illustrate, between 2011 and 2019 Dunkin’ retained ~$233M in capital (change in debt and equity) and pre-tax earnings grew by ~$250M over the same period. Merely 13% of operating cash flow has been redeployed into capital investments since 2011.

Dunkin’ has five reportable segments which include:

· Dunkin’ U.S.

· Dunkin’ International

· Baskin-Robbins U.S.

· Baskin-Robbins International

· U.S. Advertising Funds

Primary sources of income are royalty and franchise fees from restaurants, income from leasing properties to franchisees (they lease about 10% of U.S. locations to franchisees, the rest are up to the franchisee) , ice cream sales to international Baskin-Robbins franchisees, and brand licensing such as bagged coffee for grocery stores and Dunkin’ k-pods. U.S. advertising dollars are reported as revenue per GAAP but have no impact on profitability as all dollars are spent on advertising on franchisees’ behalf and are strictly pass-through. Segment profit mix is heavily dependent on Dunkin’ U.S. as you can see below.

Source: company filings, Author

Franchise networks and the all-important franchise/royalty fees are only sustainable if franchisees are successful over the long term. This entails building successful partnerships with the franchisor. Dunkin’ appears to have a good record here and speaks frequently to their strong relationships with franchisees. Below is an overview of the average Dunkin’ location and the associated returns, which offer attractive unit economics for franchisees and support continued growth throughout the U.S. which I’ll discuss later.

Source: 2019 Q3 Investor Presentation

The current pandemic has highlighted other areas in which Dunkin’ has supported franchisees. When government lockdowns first started rolling out, the management team quickly built and distributed a breakeven analysis tool for franchisees to assess various breakeven points when comp sales turned negative and helped franchisees evaluate when it made sense to remain open. The company also extended payment terms and offered deferred payment programs on franchisee and royalty fees to allow the franchisees to weather the storm.

In addition to being the largest contributor to performance, the Dunkin’ coffee business occupies an enviable industry and position therein.

Beverage-Driven Approach

While still enjoying attractive returns, quick serve restaurants like Burger King, McDonald’s, and Wendy’s are constantly reinventing their menus and offering promotions to one-up each other in the competitive lunch and dinner time segments. Dunkin’ benefits from a different dynamic by focusing on beverages to drive growth.

For reasons I can’t fully explain, drinks of all kinds – beer, soft drinks, coffee, etc. – tap into a much more habitual and loyal part of people’s lives than food. Your morning cup of coffee, most likely Starbucks or Dunkin’, on the way to the office is part of a daily ritual that is less dependent on price promotions, menu changes, and precise location than is your decision about where to eat lunch when on the road. Additionally, coffee becomes particularly ingrained in people’s daily lives as a necessary part of their routine whereas most people don’t eat a Big Mac every day, further strengthening the brand for regular customers.

Because people consume coffee so regularly (compared to French fries), it opens up customers for another benefit – loyalty programs. These programs are critical because once customers sign up they are likely to remain signed up (80%+ retrial rates) and it offers the company the chance to market to consumers on a one-to-one basis and collect data on their personal preferences. Dunkin’ has rapidly grown its loyalty member base from 2 million in 2014 to nearly 13 million today. Revenue from rewards members was 3% of sales in 2014 and is now almost 20% as mobile has become an ever-increasingly important part of the business.

Finally, menu innovation for traditional fast food restaurants often entails bringing in entirely new categories of food as there are only so many ways to reinvent the hamburger. Coffee shops, on the other hand, can create thousands of varieties of caffeinated beverages with ingredients (coffee, syrups, espresso, milk, etc.) that are easy to store and re-use. This is a trait that Dunkin’ shares with Chipotle, one of today’s most successful food-driven QSRs, as they offer countless combinations of a few core ingredients to allow customers to build their own burrito bowl / quesadilla / nachos without needing to carry a complex array of options.

To be sure, a steady supply of new espresso combinations and breakfast sandwiches and offering a good price to value proposition are still critical to quick serve coffee shops and something management teams discuss extensively with shareholders. These factors are important, but not as cutthroat as food-driven franchises which makes Dunkin’s core business more attractive.

Equally importantly to investors, the habitual nature of the beverage space allows for a reasonable degree of conviction when considering what the business will look like a few years out into the future and what cash the it should be producing at that time.

Competitive Position and Value Proposition

Now that we’ve covered that by way of luck or skillful insight Bill Rosenburg picked the right industry when founding the first Dunkin’ Donuts in 1940, we’ll look at Dunkin’s specific value proposition within the industry.

As the management team highlights on every earnings call, Dunkin’s brand is all about convenience for on-the-go coffee drinkers. The main ways they promote convenience are through the previously discussed digital initiatives with their mobile app as well as recently expanded delivery partnerships with Grubhub and Door Dash.

Dunkin’ was well-positioned going into the COVID-19 lockdowns on each of these top priorities with 90% of traffic already in some form of takeaway and the pandemic has only served to accelerate each of these. As highlighted on the Q1 call, since the pandemic began the company has added 1,000 curbside locations, doubled their delivery footprint to 4,000 stores, and increased loyalty transactions to roughly one in five. The company also touts increases in grocery/bagged coffee segment with volumes up 20-30% in the last quarter. I think it’s safe to say that whatever happens with the pandemic the business is likely to benefit over the long term as it has accelerated some of the key areas the business was already working on leading up to 2020.

The other growth accelerators, as you’ll hear consistently in the QSR space, is a simplified value-driven menu and a brand refresh with updated store concepts. The company’s NextGen store design, slimmed-down menu, and espresso program have been quite successful and well received by customers and franchisees alike. The simplified menu has allowed franchisees to save 10 hours per week in labor to be redeployed into the guest experience and resulting in higher franchisee profitability (per the 2018 analyst day presentation).

Source: 2019 Q3 Investor Presentation

These initiatives which began in earnest in 2017 have recently started to bear fruit as the company saw 3.5% comparable store sales growth, its highest comp growth in 6 years, during the first 10 weeks of Q1 before the pandemic struck.

Growth and Expansion

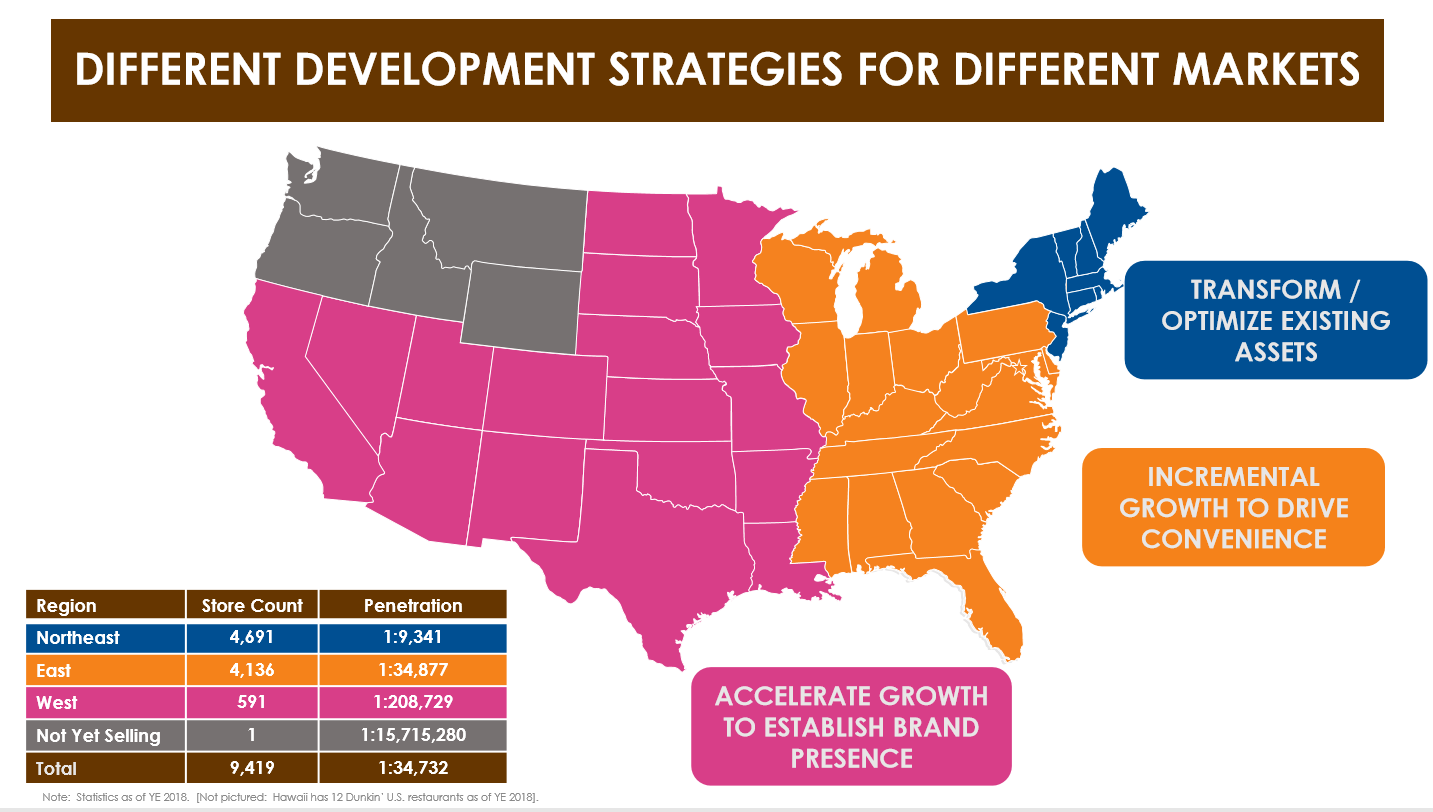

Despite occupying a leading position in the country, Dunkin’ still has ample room to replicate its successful franchise program. With continued momentum in mobile and on-the-go growth and the revised store concept, Dunkin’ is poised to continue opening new locations in the under-penetrated Western half of the U.S.

Source: 2019 Q3 Investor Presentation

Dunkin’ can pilot and tweak concepts in the more mature eastern markets and roll out successful strategies to higher growth regions once proof of concept is complete.

If Dunkin’ can obtain anywhere close to the penetration of the Northeast (1:9,341 and 4,700 stores) in the west which currently stands at 1:208,729 penetration and 591 stores, they should see steady growth for years. There’s no reason that Dunkins’ model isn’t replicable across the country, it’s mostly a matter of time in rolling out new locations and building the franchisee network.

Growth in Dunkin’ U.S., like other QSR concepts, is primarily driven by new stores and same store sales growth. The plan is to open 200-250 new stores in the U.S. each year which represents 2.0 – 2.5% growth annually. Additionally, after looking at the trends in mobile and momentum from the new store design and menu, same store sales should grow 2-3%, resulting in overall topline growth of mid-single digits (4-6%).

Though much less consequential, the Baskin-Robbins and International fronts can’t be ignored. The management team has worked to reignite growth at Baskin-Robbins’ U.S. locations and without going into detail it appears the efforts are likely to yield low single-digit comp growth annually. The company no longer guides for international revenue or income growth, but expects that business to be flat in the near-term. Significant growth opportunities should exist in China and elsewhere, but the company is (rightfully so) focused on continuing the momentum in the more profitable U.S. for now. All told 4-6% growth in the core Dunkin’ business will likely be modestly offset by slower growth in Baskin-Robbins and abroad, so I’ll call overall revenue growth ~4.5%.

Turning to the bottom line, the company has guided for a modest reduction in G&A in the near term followed by low-single digit increases thereafter, implying a percent or two of annual operating leverage for the foreseeable future. Additionally, the beauty of the 100% franchised, capital-light model (as we’ve written about with Hilton and Wyndham), is that the earnings power increases without retaining capital and nearly all of free cash flow can be returned to shareholders by way of buybacks and dividends. Dunkin’ has reduced shares outstanding by 4.5% annually (though in a lumpy matter, which is fine) for the past 5 years and pays around a 2% dividend yield. The buyback and dividend yield were recently suspended due to COVID but I expect each to be reinstituted in short order (within the next year or so) now that the economic range of outcomes has been significantly narrowed thanks to the fed. At any rate I’ll handicap the buyback yield to 3.5% given there is presently some ambiguity there. Management has presented roughly the same long-range targets for the business, and it seems reasonable that they can meet or exceed these over the next several years.

Source: 2019 Q3 Investor Presentation

Putting these together I impute intrinsic value per share growth somewhere around 11% annually for the next several years. Maybe growth is a little slower coming out of COVID, but I see upside on the yield as things normalize, so low double-digit growth seems about right.

Source: Author

None of this looks out of line, as the business has compounded free cash flow at 8% since going public, reduced shares by 5% annually, and historically paid a ~2% dividend implying a 15% return before any change in valuation multiple. Given their store-count expansion potential, 11% certainly feels doable.

So, what are investors paying for this low double-digit intrinsic value growth over the next several years?

Valuation and Stock Returns

Below are the historical median valuations and eps growth rates for Dunkin’ and similar franchise-based and QSR industry peers. Starbucks is not a franchisor but is the closest comp from a product standpoint and an excellent business in its own right. Clearly these non-cyclical, capital-light, high return, free cash flow generative businesses should garner premium valuations as long as they have room to continue replicating their model. As you can see, Dunkin’ has historically traded around 25x earnings since going public in 2011.

Source: Author and ValueLine Review

The aim is to buy below fair value, preferably substantially so, to protect against any of the assumptions falling short of expectations or other unforeseen events. Dunkin’ currently trades at around 21x 2019’s earnings, a modest discount to historical valuations, but no bargain. Below you can see the impact of the change in multiple on prospective returns when combined with the growth in the underlying business based on the current valuation.

Source: Author

It’s hard to imagine a business of this quality trading below 20x for any extended period, and the lowest average annual P/E in the company’s 10 year public history is 20.7x. The business has garnered an average annual P/E of 27x or higher 30% of the time since going public. I wouldn’t bank my investment thesis on a continued mid-20s valuation multiple but I also think it seems reasonable given the growth prospects and business quality.

Given we are after mid-to-high teens returns with a substantial margin of safety I would get very interested in buying Dunkin’ if it approaches anywhere near a market-average valuation for whatever reason. Shareholders should do well from recent prices, and I think investors would do excellent taking a patient approach and buying Dunkin’ between 15x – 17x if the opportunity presents itself. Returns from those levels could exceed 20% annually for several years.

One of the best parts about investing in an asset light compounder is the downside protection. Consider a scenario where the business fails to hit its growth targets and instead grows at only 3% annually, and the multiple contracts to 15x. Because of its free cash flow generation, the company would be able to return over 6% of its market cap annually (1/15x) and returns would still be around 9% per year, far from a disaster. In that sense the quality of the business model provides perhaps more of a margin of safety than the price paid.

Risks

As with any investment Dunkin’ is not without risks, and I see a few areas that investors should scrutinize most carefully.

Pandemic Related Franchisee Defaults

Given the success of the franchisor is tied directly to the success of the franchisee and Dunkin’ owns real estate that is leased to franchisees, considering the possibility of widespread franchisee defaults is important. To me this seems like a very low probability after listening to the management team during the Q1 call as well as seeing the economy slowly reopen over the last month. Franchisees are still profitable even with significant sales declines and given their reliance on carryout ordering they have been much less impacted by government-imposed shutdowns than their dine-in counterparts. Franchisees have also benefited from the government stimulus as most qualify for PPP loans and other programs through the Cares Act. As mentioned, many also have deferred franchise payments to Dunkin’. All in all there are no major red flags to me that would suggest meaningful closures due to the pandemic.

Baskin-Robbins and International Business

I think a bigger risk to results comes from Baskin-Robbins and the international businesses creating a distraction from the more profitable U.S. Dunkin’ brand. Management seems to be balancing this well so far, and spends most of their time discussing the U.S. Dunkin’ strategy. It’s also not as if the Baskin-Robbins or International segments are losing money or destroying value. The main risk is the company has slower overall growth than projected if these become larger drags on the topline or take attention away from the core strategy.

Conclusion

Studying the franchise space as a whole is a worthwhile exercise given the predictable, free cash flow generative natures of most franchisors, and Dunkin’ is no exception. Dunkin’ Brands is a growing, easy to understand, capital-light business in the attractive beverage-led quick serve restaurant space. The core business should compound intrinsic value over 10% annually with a reversion to historical valuation multiples providing additional upside. I’ll watch Dunkin’ closely and if and when it approaches an “average” market valuation for a period of time I would likely be an eager buyer.

Disclosure: The author, Eagle Point Capital, or their affiliates may own the securities discussed. This blog is for informational purposes only. Nothing should be construed as investment advice. Please read our Terms and Conditions for further details.