Costco: A Wonderful Business But Priced For Perfection

There are, generally speaking, two business models that work. The first is to provide customers with the lowest prices. The second is to convince customers to pay higher prices. Companies like Costco, Amazon, and GEICO use the first model while companies like Apple, Starbucks, and Nike use the second. Virtually every business lies somewhere on a spectrum between these two extremes.

The worst businesses are stuck in the middle. Their prices aren’t the lowest, but their products aren’t the best and they can’t raise prices without losing volume. The best businesses lean into one extreme or the other. As Charlie Munger once observed:

In business, we often find that the winning system goes almost ridiculously far in maximizing and or minimizing one or a few variables—like the discount warehouses of Costco.

Low prices are in Costco's DNA and pervade everything it does. Usually, companies use economies of scale to increase their margins and profits. Costco is different.

When Costco finds a way to lower costs, they also lower prices. They don't keep the extra margin for themselves. This creates a virtuous cycle. Lower prices produce higher sales volume, which generates economies of scale, and allows Costco to lower prices again.

Costco’s low gross margin demonstrates this. Gross margin measures how much a retailer marks up their goods over their wholesale cost. Costco’s is just 11%, half of its nearest competitor.

Source: Author, SEC Filings

Low gross margins are a feature, not a bug, since Costco's efficiency still allows it to earn competitive operating margins.

Source: Author, SEC Filings

Costco manages the same operating margin with half the gross margin because of its membership fees and efficiency.

Over the last five years, membership fees made up 98% of Costco's net income. In other words, Costco isn't really trying to make money by selling goods. They markup products just enough to cover their meager overhead. The real profit center is membership fees. The low prices are a way to encourage customer loyalty, as seen in their 91% U.S. renewal rate.

As you can imagine, this is a tough model to compete with. Kroger, Walmart, and Target don’t have membership fees to fall back on. They actually have to mark up goods enough to earn a profit, virtually ensuring they’ll never have prices lower than Costco’s.

Costco’s other advantage is its efficiency. SG&A (sales general and administrative) is about half of its competitors.

Source: Author, SEC Filings

There’s no single reason Costco’s SG&A is so low. Rather, Costco’s efficiency comes from a relentless optimization of the details, day in, and day out.

Warehouse Design

Costco’s efficiency starts with its warehouses. Costco's founder, Jim Senegal, understood that customers come for the low prices, not the ambiance. So, Costco's warehouses are utilitarian: cheap to build, cheap to maintain, and easy to stock. Employees can move pallets directly from the receiving dock to the selling floor, minimizing labor.

Merchandising

Retailers like Walmart and Target typically carry 100,000 to 140,000 SKUs. Costcos carry less than 4,000. One reason is to save on labor. Jim Sinegal explains:

If you go into a typical supermarket, you would find about 350 SKU's in the aisle. Various sizes and brands. We go out, and we try and find someone who will make the largest box of cereal in the world, put it on a pallet, and we simply move it into position with a pallet jack. If you think about the labor involved in cutting open cases and hand stacking merchandise on the shelf, and ringing through a lower ticket item, you start to see the scope of the savings. Costco will have about 12 cereal items compared to 350 at a typical supermarket.

Bargaining Power

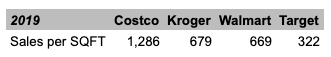

A limited selection also maximizes Costco’s bargaining power. Costco typically offers just one or two types of each product: a national brand and perhaps a Kirkland version. This concentrates Costco’s customer’s buying power into a single product or two and allows the company to move huge volumes. You can see this in Costco’s sales per square foot which are double their competition.

Source: Author, SEC Filings

Because Costco’s shelf space is so valuable and so limited, vendors compete tooth and nail for it. Costco uses its bargain power to extract lower prices and demand higher quality from its suppliers. Suppliers jump through these hoops — lowering prices and developing special products for Costco — because they can count on huge sales without spending a dime on advertising. What they lose on margin they’ll often regain on volume.

Inventory Management

Costco’s high sales velocity allows for rapid inventory turns. This minimizes working capital, increasing returns on capital, and minimizes food spoilage.

Costco sells inventory so quickly that vendors unwittingly finance it for free. Costco’s 10-K says:

We generally sell inventory before we are required to pay for it, even while taking advantage of early payment discounts.

Costco maintains a ratio of payables to inventory greater than 100%.

Source: Author, SEC Filings

Minimal Shrinkage

Retailers typically lose 1-2% of sales to shrinkage (aka shoplifting). Costco only loses 0.11%, according to Barron’s. There are a few factors behind this: Costcos only have one entry and exit, employees check receipts at the door, members are generally affluent, and products are often too bulky to sneak out.

Receipt checkers are unique to Costco, at least among direct competitors. Competitors don't have receipt-checkers because they want to minimize labor. Costco takes a different approach. Rather than minimize labor, Costco minimizes total overhead. They’ve found that receipt checkers are a good investment.

Labor

Labor is one of retail’s largest expenses. According to Jim Sinegal:

Of all the money we spend on running our business, seventy cents of every dollar we spend is spent on people. It is by far the most significant expense ratio we have. If you are going to spend 70% of everything you spend you better do that well.

Linear thinkers minimize labor by paying the minimum wage. But Costco is run by second-order thinkers who understand that different wages garner different labor productivity. As with most things, you get what you pay for. Accordingly, Costco pays average wages 65% higher than its competitors.

It almost seems too good to be true: Costco provides lower prices while paying higher wages and still produces competitive net margins? The secret is, once again, efficiency and productivity. Higher wages attract more productive employees, keep them motivated, and minimize turnover.

Culture

Costco’s managers are all home-grown. Most work 10-15 years at a warehouse before joining management. This produces a deep well of institutional knowledge and ensures Costco’s customer-centric culture remains intact.

Every company claims its culture and its people are its greatest assets, but it might actually be true at Costco. In theory, there's no reason why a competitor can't copy everything Costco does. After all, Jim Sinegal copied the Costco model straight from Sol Price's Price Club.

So why hasn’t someone copied Costco? One reason is incentives. There’s a tremendous incentive to raise prices today to juice profits. The math practically begs it. It might sound simple on paper to “think long term” and pass the savings onto the customer, but it’s a lot harder when bonuses are at stake.

It requires long-term second-order thinking to understand that lower prices today maximize long-term profits. Jeff Bezos explained this paradox in Amazon’s 2005 letter to shareholders:

As our shareholders know, we have made a decision to continuously and significantly lower prices for customers year after year as our efficiency and scale make it possible. This is an example of a very important decision that cannot be made in a math-based way. In fact, when we lower prices, we go against the math that we can do, which always says that the smart move is to raise prices. We have significant data related to price elasticity. With fair accuracy, we can predict that a price reduction of a certain percentage will result in an increase in units sold of a certain percentage. With rare exceptions, the volume increase in the short term is never enough to pay for the price decrease. However, our quantitative understanding of elasticity is short-term. We can estimate what a price reduction will do this week and this quarter. But we cannot numerically estimate the effect that consistently lowering prices will have on our business over five years or ten years or more. Our judgment is that relentlessly returning efficiency improvements and scale economies to customers in the form of lower prices creates a virtuous cycle that leads over the long term to a much larger dollar amount of free cash flow, and thereby to a much more valuable Amazon.com.

Costco's customer-centric culture is the only force opposing the natural inclination to increase profits today. At the core of Costco's culture is the desire to be the "absolute pricing authority." Jim Sinegal explains:

We have to be able to show a savings on everything we sell. If we can't show a savings we won't carry it. We've had situations, like in Portland, where for about two years we didn't carry sugar because every supermarket was selling sugar below cost. We couldn't save our customers any money. Our attitude was if they came in and see we couldn't save them any money on the sugar, they have every reason to believe that maybe our pricing isn't so hot on Michelin Tires or a television. It's a chink in the armor and we won't engage in that.

Advertising

You’ve probably never noticed, but you’ve never once seen a Costco commercial or billboard. That’s because Costco doesn’t advertise beyond mailing flyers to members a few times per year. Jim Sinegal explains:

In our business advertising is cost. If you advertise, you have to raise the price of the merchandise — it is that simple. We are working on margins that do not allow us to spend 1 or 2 percent on advertising. Also, advertising becomes like a drug. I use the expression: It's like heroin, once you start doing it, it is very hard to stop. We feel that the most successful type of advertising is word of mouth. When people are saying good things about you, it is much more important than when you say them about yourself. Word of mouth is the most effective type of advertising.

Treasure Hunt Psychology

A quarter of Costco’s SKUs is rotating merchandise. They’re spread out between staples so that customers spontaneously discover them.

Costco knows its customers want a rock bottom price on staples like maple syrup. But what really gets them excited is a $20 Under Armor shirt they know would cost $40 in a department store. These products are what really drive loyalty and word-of-mount raving. Finding these treasures triggers a dopamine rush that keeps customers coming back for more.

Private Label

Last but not least, a discussion of Costco is not complete without mentioning Kirkland. Kirkland is Costco’s private label brand and almost universally praised for its quality and value.

Warren Buffett has marveled at how Kirkland overtook Kraft Heinz from a standing start in 1992:

Here they [Kraft Heinz] are, 100 years plus, tons of advertising, built into people's habits and everything else, and now, Kirkland, a private-label brand, comes along and with only 750 or so outlets, does 50% more business than all the Kraft Heinz brands.

Costco accomplished this by demanding that every Kirkland product meet three criteria:

It has to be better than the leading national brand. Costco uses independent research to verify that each Kirkland product is at least 1% better than the industry leader on a key performance metric.

It has to be 15-20% cheaper than Costco would sell the leading national brand at.

It has to be important and something customers actually want to buy.

Costco’s business model is built on the extreme minimization or maximization of every detail, no matter how small. Kirkland is where that shines through most. No wonder it has become one of the largest brands — let alone private label brands — in the world.

Forward Returns

If you can’t tell, I think Costco is a wonderful business. It’s one of the few that provide a win-win for every group of stakeholders: customers, employees, suppliers, and owners. But good businesses don’t automatically make good investments. The price has to be right. So, what's Costco worth?

Costco has 795 warehouses and has added about 20 per year in each of the last five years. That's a 3% growth rate. Membership has grown faster, at 5%. This has helped overall sales compound at nearly 9% over the past five years.

I expect similar results over the next five to ten years. Though it’s becoming more difficult to find suitable locations for new warehouses in the US, there’s plenty of room to expand internationally. The concept travels well. So well that Costco’s Shanghai store had to close early on opening day because it was swamped with crowds!

Sales growth will likely exceed new store growth because warehouses tend to generate more sales the longer they’re open. It takes time for locations to attract members and grow by word of mouth. In my opinion, 3-4% of same-store sales growth seems like a reasonable assumption. Combined with 2-3% new store openings, growth could average 5-7% annually for some time. Growth may be higher in reality, but I don’t like pricing for perfection.

This growth is worth 21-36x using a 10% discount rate and would value Costco between $109 and $206 billion. That's admittedly a wide range and demonstrates how hard it is to pin down an exact price for even a simple and steady business.

Today Costco is worth $160 billion or 40x earnings. This price doesn't appear to offer much margin of safety. Costco is a wonderful business, but that's no secret anymore, and its price reflects it. To buy Costco here, you'd have to expect an accelerated pace of warehouse openings, double-digit same-store sales growth, or else be willing to accept a lower forward return.

If growth averages 6%, dividends and buybacks can add 1% of yield. But if the multiple contracts from 40x to 30x, forward returns will only total about 2% over the next five years. I might be sandbagging growth a little — it could certainly come in higher. But I don't think the stock is likely to sustain a 40x multiple indefinitely. Costco’s multiple seems destined to contract. If the stock sells off 25-50%, I’d be an eager buyer.

Disclosure: The author, Eagle Point Capital, or their affiliates may own the securities discussed. This blog is for informational purposes only. Nothing should be construed as investment advice. Please read our Terms and Conditions for further details.